Dr. R. A. Foxworth, FICC, MCS-P

Like most of you, I became a chiropractor to help people. I knew that I’d also be the owner of a small business, but I didn’t really consider what being an entrepreneur would entail. Even if I had, I surely could not have predicted how complicated and highly regulated chiropractic would become. I was blissfully unaware of Medicare and OIG compliance, private insurers and records requests, coding and documentation requirements. Unfortunately, our good intentions to help our patients without the knowledge of the layers of rules and regulations can result in fines and penalties from state and federal regulators.

I recently read a story about doctor who was so convinced that patients were entitled to all the care they needed—or that was available under the policies they paid for—that he hired an attorney to pursue payment in cases where treatment was denied. While that sounds warrior-like, it really demonstrates a less-than-adequate knowledge and understanding of the rules and regulations that govern our practices. This doctor is currently serving a federal prison sentence.

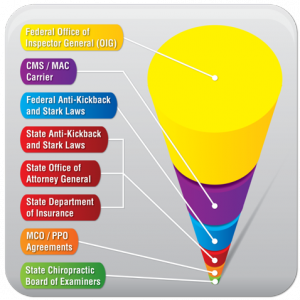

We start off in practice not fully realizing that we are regulated by a health care “system,” and we must comply with ALL layers of that system. Respect the rules and regulations from your Boards of Examiners, Provider Agreements, State Departments of Insurance, Attorney General’s offices, CMS, and the Offices of Inspectors General. It’s sounds like a daunting task, but it is possible with the proper office financial policy.

Here’s the thing. The rules are real, and the risk of not following them is high. Give a partially-insured patient a bit of a break, and Boom! You may have created an inducement violation. Offer a free exam or x-ray to help get new patients in the door, and Bam! Inducement or anti-kickback violations could have occurred. Call a few of your competitors around town, ask what they charge, and then base your fees on what you learn? Now you’ve gone and engaged in illegal price-fixing under the Sherman Antitrust Act.

Here’s the thing. The rules are real, and the risk of not following them is high. Give a partially-insured patient a bit of a break, and Boom! You may have created an inducement violation. Offer a free exam or x-ray to help get new patients in the door, and Bam! Inducement or anti-kickback violations could have occurred. Call a few of your competitors around town, ask what they charge, and then base your fees on what you learn? Now you’ve gone and engaged in illegal price-fixing under the Sherman Antitrust Act.

All of these actions, no matter how ignorantly or innocently undertaken, can mean big fines. They’re also likely to win you a trip under an auditor’s microscope, one that may well turn up documentation errors and result in recoupments so large they can put you out of business.

This thought is likely far out of your realm of reality. As you sit in your chiropractic classes with your eyes on graduation and your shiny new license not quite in your possession, it is hard to consider that all of the practical knowledge that you gain in school does not replace the need to have adequate knowledge and understanding of rules and regulations that will govern your future practice.

Join ChiroHealthUSA every Tuesday free webinars presented by the top names in chiropractic. Our presenters discuss everything from compliance, coding, and audits, to how to build a successful practice. You can view a list of upcoming webinars here.

Dr. Ray Foxworth is the founder and President of ChiroHealthUSA. Since it’s inception in 2007, ChiroHealthUSA has donated over $750,000 to help support state associations, COCSA, F4CP and the CCGPP. The Foxworth Family Scholarship is funded by ChiroHealthUSA and will be awarding one student a $10,000.00 scholarship in August 2016. The winning student’s school will also receive a donation of $10,000.00. For more information on how to apply, go to www.chusascholar.com.

▶︎

▶︎  Why is the Discount Challenge prize amount $15,024? Because that is the average “per-occurrence” fine for Medicare inducements. That’s not $15,024 per patient, that’s not per provider, that’s PER VISIT. Stinks, doesn’t it? To us, the prize amount is worth the investment if we can help our profession better understand proper discounting.

Why is the Discount Challenge prize amount $15,024? Because that is the average “per-occurrence” fine for Medicare inducements. That’s not $15,024 per patient, that’s not per provider, that’s PER VISIT. Stinks, doesn’t it? To us, the prize amount is worth the investment if we can help our profession better understand proper discounting.