Ray Foxworth, D.C., FICC, MCS-P

Monitoring your cash flow in practice is a no-brainer. However, when it comes to reviewing your accounts receivable, many providers and staffs don’t know the relevant benchmarks to use for determining if those numbers are good, bad, or plain ugly. Often, numbers are reviewed monthly. Even if your cash flow seems adequate now, evaluating your collections on a weekly basis will give you time to make corrections before a problem occurs. Most EHR software collection reports will tell you the gross collection percentage for all payer types. But, the reality is that this number doesn’t tell the whole story. You are seeing the preview, but not the whole movie.

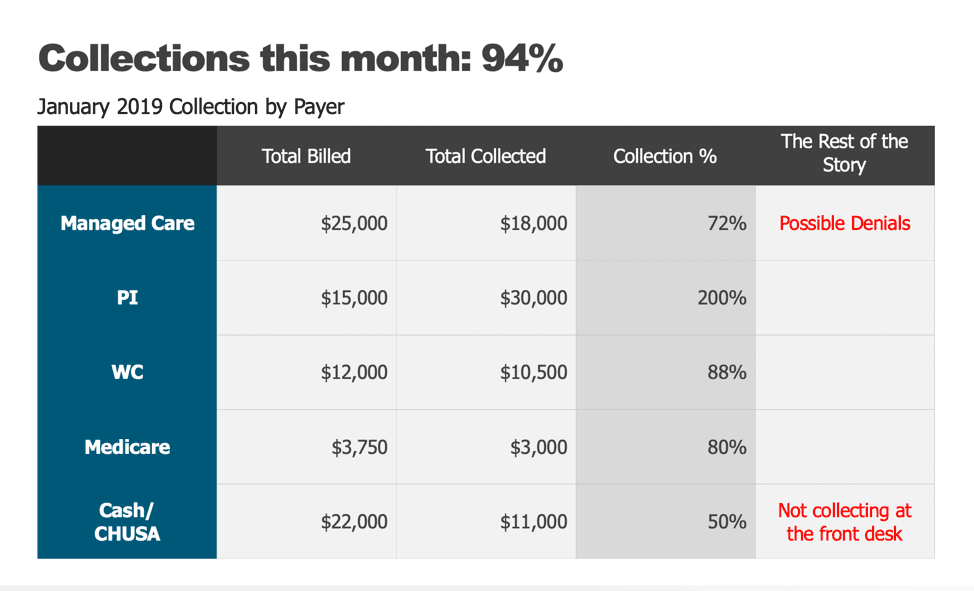

You may be like many practices that incentivize their staffs for improving collections in the office. However, if bonus eligibility is based on the overall collection percentage, you could be missing potential problems that could signal cash flow issues on the horizon and wind up paying out bonuses in error. Or worse, you may THINK you are killing it in collections because the overall numbers are skewed by a number of potential factors. For example, your monthly report shows your collections at 94%. Everything looks great. You pay the bonuses and look forward to next month’s report. But, if you had reviewed your collection percentages by payer type, you may get a different story altogether. In the chart below, it is easy to see that this clinic had a great collection rate in PI, but that number could be skewed by old cases settling. It looks good on the surface, but you can see the importance of digging deeper.

By viewing each category, you can identify potential errors and resolve them. Has there been an increase in denials? If so, are they being followed up on? Perhaps a payer is holding claims, or Medicare has stopped paying claims for one provider in a multi-provider office. Additionally, it could be that your patients are feeling the pain of rising out-of-pocket costs. According to a study released in June 2018, increases in cost-sharing payments continue to outpace wage growth. Regardless of the reasons, when you look at your collections by specific payer, you can get a more accurate gauge of the financial health of your practice, identify problems, and resolve them more quickly. If your accounts receivable could use a little help, here are a few tips for increasing collections in the office.

1. Collecting at the front desk. If you have employees who struggle with discussing money with your patients, take time to script, train, and practice the financial conversation frequently. Collecting co-pays and deductibles from your patients may be a challenge, but not collecting them could expose your practice to potential compliance risks. available.

2. Conduct a Financial Report-of-Findings (FROF). You know that the clinical report-of-findings is a necessary tool for your patient to understand your care recommendations. Setting aside time for a member of your team to discuss what insurance will, and won’t, cover, and reviewing your financial policy, establishes an expectation of payment for services and gives the patient an opportunity to ask fee-related questions.

3. Provide payment options. It goes without saying that your office should accept a variety of credit cards. But, can your patients pay online as well as in the office? Do you offer auto-debit as a payment option? Not only does it help to automate the payment process in your practice by establishing a payment amount, and dates of withdrawal, during the FROF, but it also increases productivity by eliminating the need collect payments at the end of each visit. Some auto-debit systems even integrate with EHR software programs. Once they are set up, they automatically withdraw that patient’s payments and post them to their accounts.

4. It’s not always the patient. You may find that your patients are paying promptly and that the problem lies within your billing/insurance office. Incomplete CMS-1500 forms, lack of documentation, incorrect use of modifiers, and failure to obtain insurance verification promptly, are small issues that can create an accounts receivable nightmare. Claims denials are often a big problem and can cost your practice a lot of money. All denials should be reviewed and responded to quickly. In many cases, a simple phone call to the payer can resolve the issue.

Knowledge is power. Commit to reviewing these numbers in your weekly staff meetings. If you detect a problem with collections, you will be able to resolve it quickly and efficiently. And, realize that one week does not make a month, and one month doesn’t make a year, so don’t overreact or over-correct based on a good week, or month. Understand that you are looking for trends, patterns, and the overall health of your collections, with the hope of identifying and making corrections along the way. Help your staff get comfortable with the conversations.

If you’d like to have fun one day, take a field trip to an orthodontist’s office and watch how easy it is for them to get parents to commit to a $7,000 case for care. Or perhaps visit a plastic surgeon’s office that is all-cash and see how quickly their staff closes the deal. $16 BILLON was spent in the U.S. in 2016 on elective plastic surgery. Impressive numbers, but there is no reason why our staffs can’t learn to do the same thing in our offices.

▶︎

▶︎  Why is the Discount Challenge prize amount $15,024? Because that is the average “per-occurrence” fine for Medicare inducements. That’s not $15,024 per patient, that’s not per provider, that’s PER VISIT. Stinks, doesn’t it? To us, the prize amount is worth the investment if we can help our profession better understand proper discounting.

Why is the Discount Challenge prize amount $15,024? Because that is the average “per-occurrence” fine for Medicare inducements. That’s not $15,024 per patient, that’s not per provider, that’s PER VISIT. Stinks, doesn’t it? To us, the prize amount is worth the investment if we can help our profession better understand proper discounting.